Soft landing or no soft landing, that is the question, with all due respect to William Shakespeare. But while this may be the most commonly asked question these days, it may not be the most important or the toughest. That honor goes to what’s priced in. Good market forecasts are not just about the economy and earnings—they are about what the market is pricing in. Below we share our thoughts on the potential for a soft landing, the possible role China might play in that, and whether markets are pricing in too much good news.

Strong Job Market Supports Case for Soft Landing

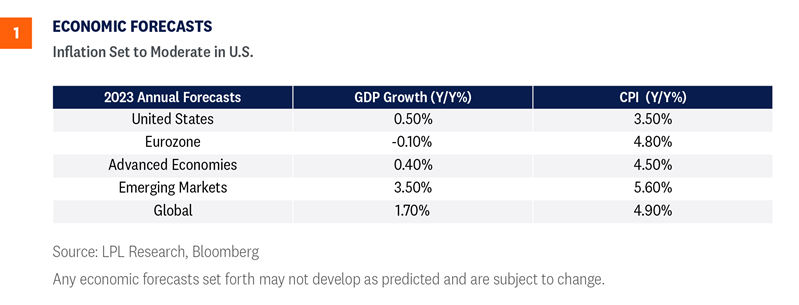

Recent economic and market data have reignited conversations about a potential soft landing. As we wrote in Midyear Outlook 2022: Navigating Turbulence, the ongoing economic recovery from the global pandemic required businesses and consumers to pilot the economy into a soft landing but that path would go through turbulence. As we subsequently developed Outlook 2023: Finding Balance, we thought the markets would be choppy as the world found its balance, while we waited for inflation to decelerate and central banks to ease up on their rate hiking campaigns.

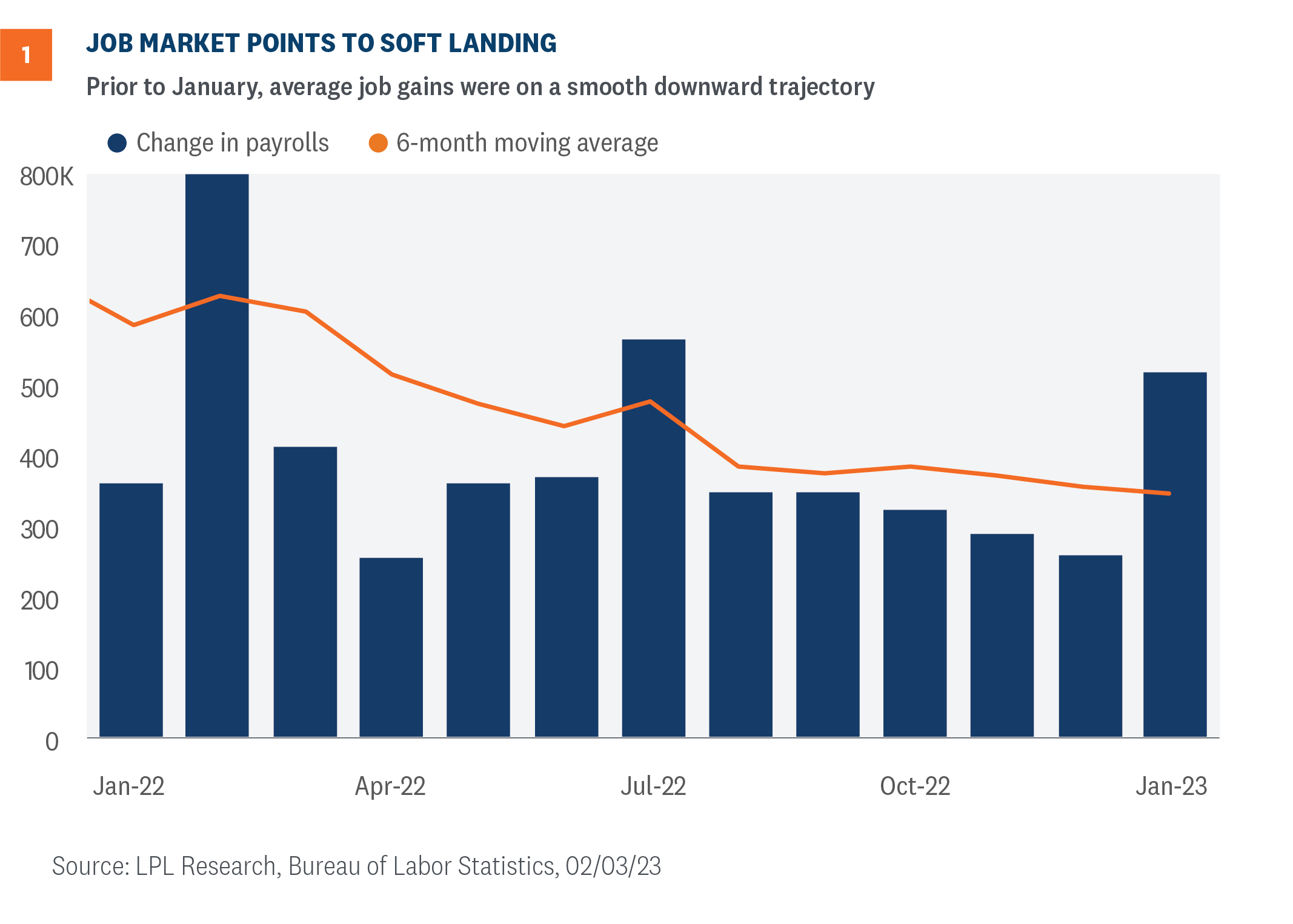

So where are we in the business cycle? If you focus on jobs, the U.S. economy is headed toward a soft landing. Excluding the blowout report for January, average job gains were on a smooth downward trajectory (Figure 1). Minimal turbulence in the trend line is consistent with a pathway to a smooth landing. In fact, the blowout jobs report did not alter the Federal Reserve’s (Fed) playbook.

The unemployment rate was 3.4% as the labor market is still very tight—too tight for central bankers. But more importantly, wage pressures are abating. Growth in average hourly earnings continues to slow, easing down to 4.4% year-over-year in January.

Low participation rates continue to weigh on the minds of economists and investors, but it’s important to remember that business formation stats are consistently growing above pre-pandemic levels, revealing many workers’ interests in alternative employment and one reason why some of the workers remain out of the official labor force.

So bottom line here is the labor market is still solid, offsetting some risk of slower consumer spending. Additionally, the slowdown in average hourly earnings should ease inflationary pressures in the near term as wage growth comes back in line. No doubt the Fed will continue to increase rates at the next meeting to slow the demand side of the economy.

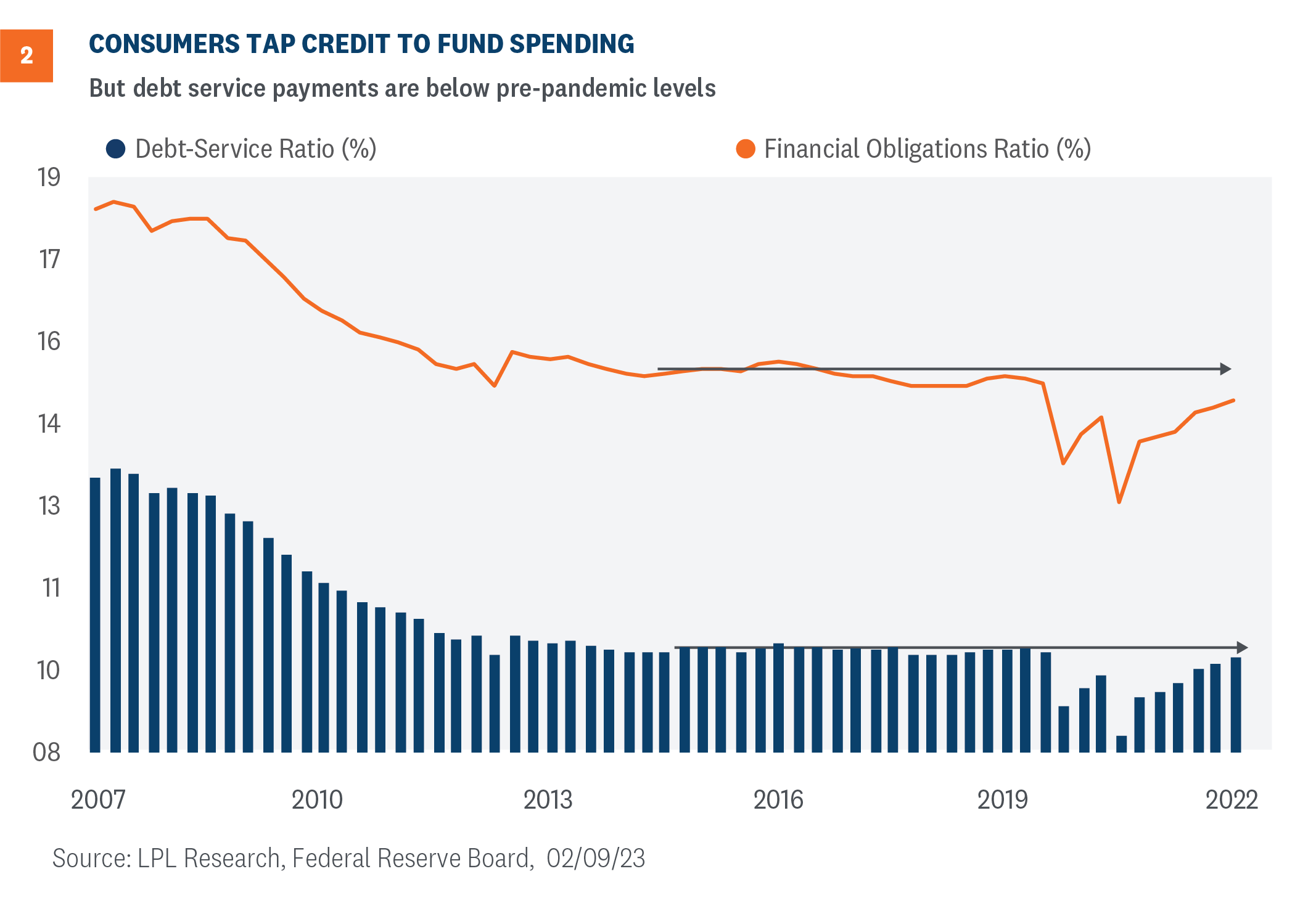

Consumers’ Debt Load Remains Manageable

As Figure 2 illustrates, consumers hold much less debt now relative to previous cycles. After the Great Financial Crisis, consumers started aggressively deleveraging. Overall debt payments as a percent of disposable income declined and remained steady until the emergence of COVID-19 and most recently, the debt service burden on the American household moved back up to pre-pandemic levels but still relatively low. The job market is tight, which means personal income growth is supporting consumer spending along with the accumulated excess savings. To further pad personal spending, consumers will likely tap into consumer credit. We expect revolving credit demand to increase in the first part of this year, but we don’t expect debt service payments to approach rates last seen in 2007 and 2008. This manageable debt load is a key component of the case for a possible soft landing.

China Reopening May Help

As the world’s second largest economy, China’s economy reopening could help prospects for the U.S. in 2023. The International Monetary Fund (IMF), which recently upgraded its global growth forecast for 2023 to 2.9%, listed China and India as economic “bright spots” contributing to nearly half of global growth for 2023. China is expected to expand by 5.2% as the stringent Zero-COVID-19 measures that hampered its economy during the pandemic have been lifted.

Similarly, global ratings agency Fitch recently revised its 2023 forecast for China’s economic growth to 5.0% from 4.1%, noting that “consumption and activity” are recovering at a faster pace than initially expected. The Purchasing Managers Index (PMI), an important indicator for growth, has already begun to reflect a sharp rebound in activity, with a jump from 41.6 in December 2022 to 54.4 in January 2023.

According to official government announcements and reports, consumer spending and support for private businesses are a top priority to help stabilize the sputtering Chinese economy. China’s debt-laden real estate sector is also a major area of the economy that is scheduled to be helped by government support, including lower interest rates to help property developers.

Chinese officials have embarked on a campaign to revive its longstanding trading relationships, with high level visits and talks with Europe and Australia. Despite difficult bilateral relations with the U.S., there are indications both countries seek to continue trade ties, as China remains an integral part of the global supply chain. In addition, U.S. companies have continued operations in China and expect their earnings to increase as the economy gains momentum.

For the global economy, China’s recovery and resilience should help underpin the broader worldwide recovery. The healing of remaining supply chain challenges will be an important factor in the normalization in global economic growth, as will the normalization of overall trade relations. If the U.S. is going to achieve a soft landing, China’s impact on global growth will likely be a meaningful part of it.

Is a Soft Landing Priced In?

The outlook for economic growth and corporate profits is always a good place to start when forming a view of the equity market, but that’s only the first step. Next we ask perhaps the tougher question—what’s priced in?

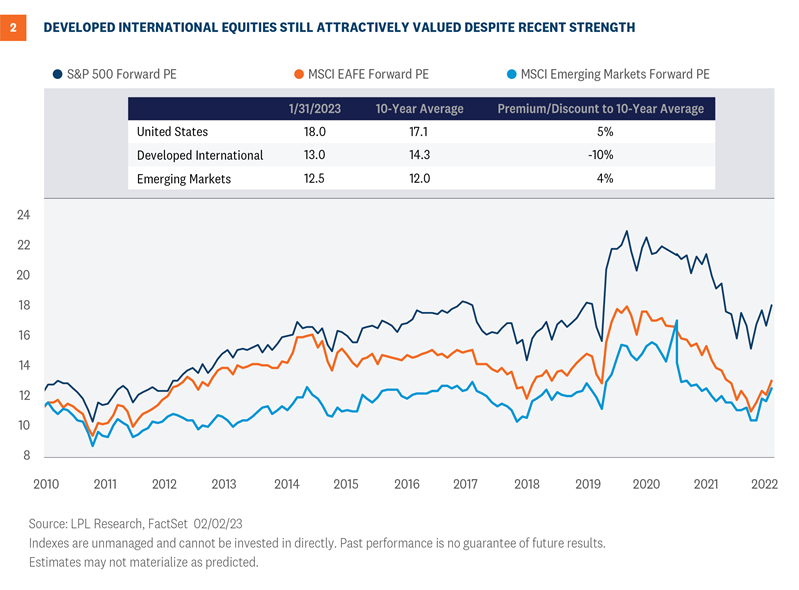

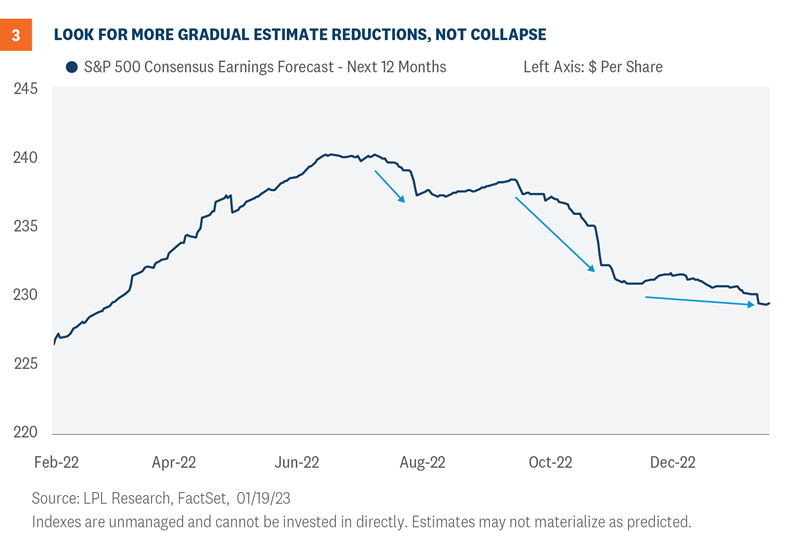

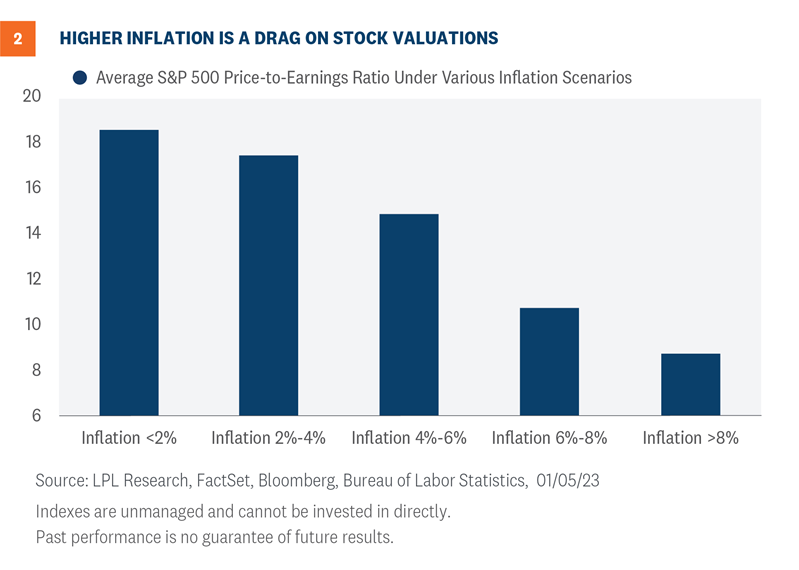

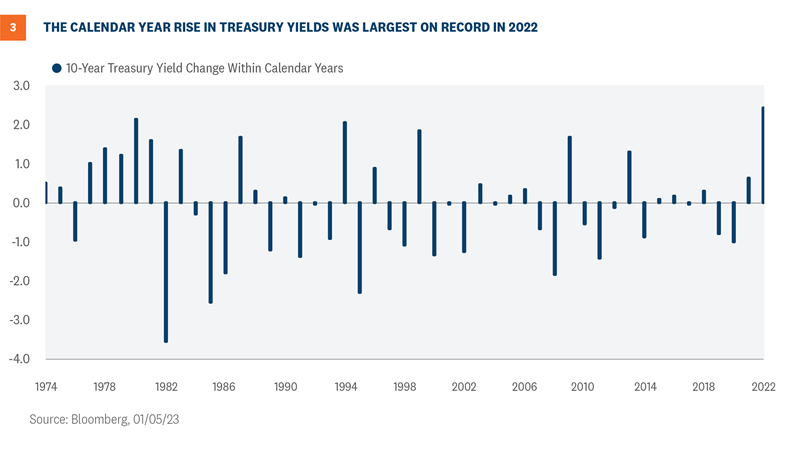

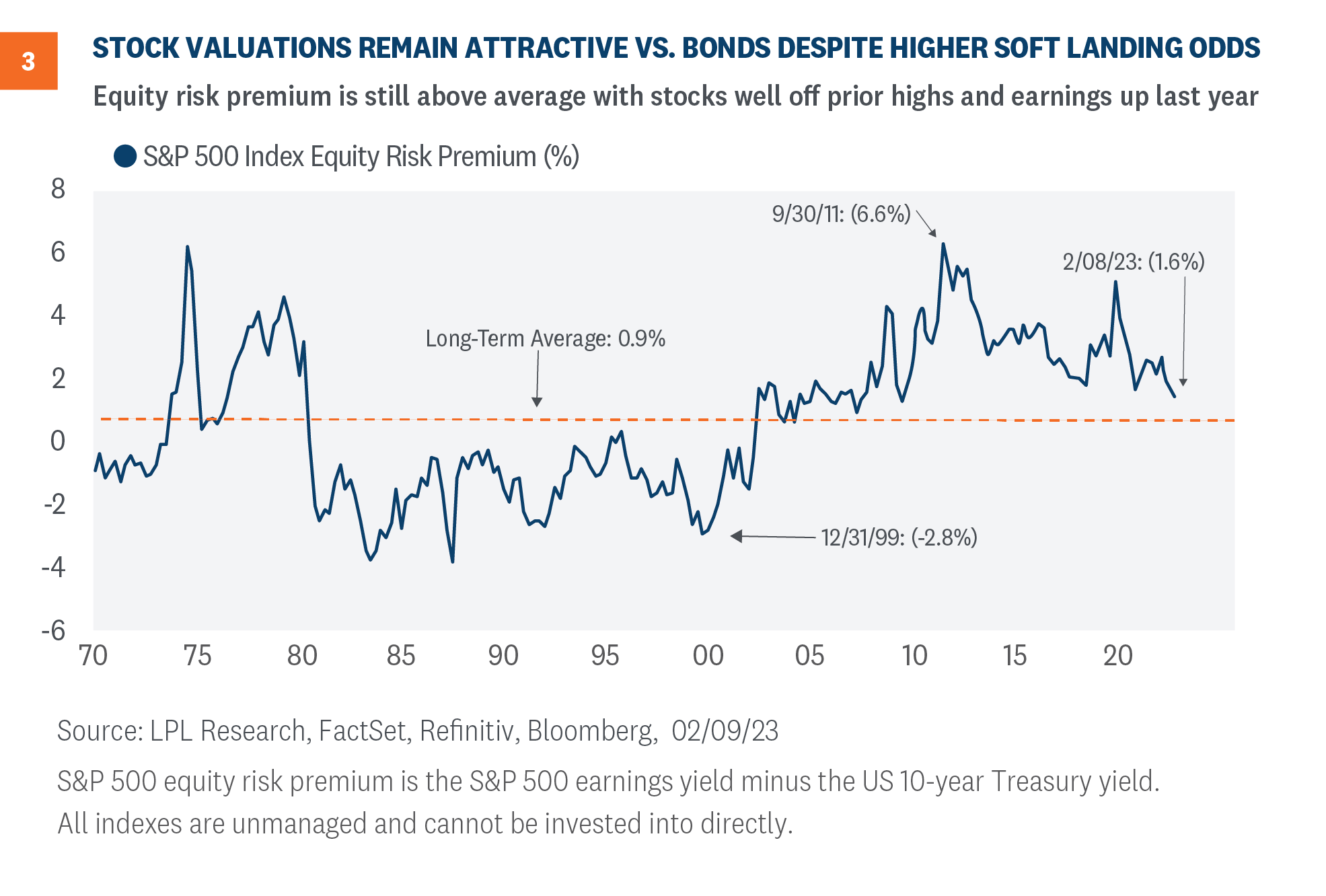

The simple way to answer this question is with a basic price-to-earnings ratio (P/E). On a trailing four quarter basis, the S&P 500 Index is trading at a P/E of 19, in line with the 30-year average. That suggests valuations are fair and that a soft landing, or short-lived, mild recession, is probably priced in. Earnings are a bit depressed, supporting higher valuations, but the challenging near-term economic outlook with still-high inflation and more Fed rate hikes forthcoming, perhaps argue against that. Upside risk to interest rates may also argue against that, though LPL Research sees manageable upside to yields this year from current levels at a 3.7% 10-year Treasury.

Interest rates are a powerful force in equity valuations as a lower risk alternative. Factoring in rates and calculating an equity risk premium (ERP, earnings / price vs. 10-Treasury yields) gives us a below-average valuation (Figure 3). The ERP of 1.6% is currently above (more attractive) the long-term average ERP of 0.9%, though it is one of the more expensive readings of the past decade, given the big jump in yields since summer 2020.

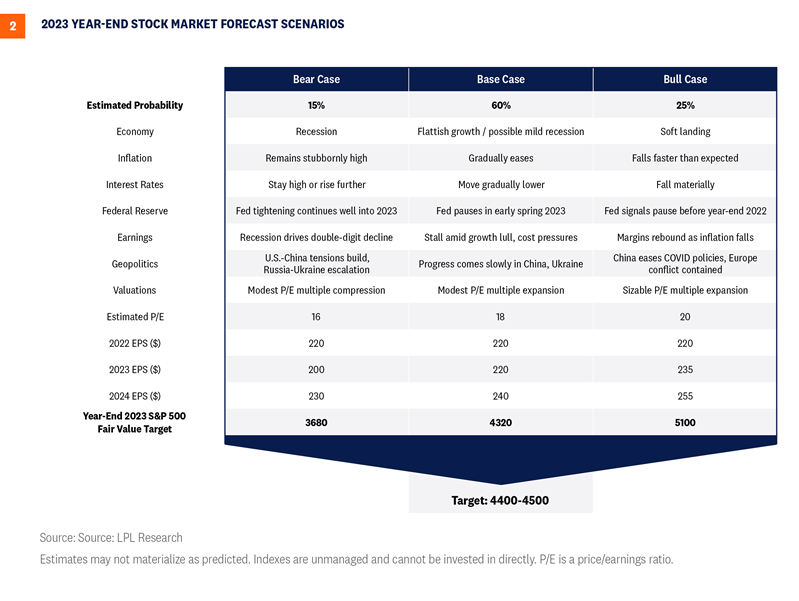

So, do these higher valuations mean more downside risk for stocks? Not necessarily. The average bear market decline in a recession is about 29%. That includes all recessionary bear markets, including the really bad ones such as 2000–2002 and 2008–2009. Even if we get a recession this year, we simply do not expect it to be as deep as those two instances, suggesting the 25% peak-to-trough decline in the S&P 500 last year may have been sufficient to price in the risk of the current economic environment.

Another way to assess downside risk is to apply more of a typical recessionary haircut to valuations and earnings. Instead of 18–19 times $240 in 2024 (LPL Research base case assumptions), 16 times $230 in 2024 puts the S&P 500 at around 3,680 at year end (the index closed at 4,090 on Friday, February 10), seemingly a reasonable bear case scenario as laid out in our Outlook 2023: Finding Balance publication.

Evidence Investors Are Strongly Embracing Risk

Another way to assess what the market is pricing in is by looking at the strength in high-beta stocks year to date relative to their low beta (or low volatility) counterparts. Better returns for high-beta, or higher volatility, stocks indicate investor risk taking and, presumably, increasing odds of a soft landing. The strength of high beta stocks in January was the ninth best month out of the past 30 years (360 months), or higher than the third percentile. This suggests maybe the soft landing is priced in and any disappointment could result in some downside to stocks.

Bottom line, while we acknowledge downside risk to earnings in a recession scenario, the risk to valuations from further increases in interest rates, and the market’s increasing optimism based on where the biggest 2023 gains are so far, we expect the October lows to hold and see solid, double-digit gains for stocks in 2023.

Conclusion

The 14% move for the S&P 500 off the lows last October, despite the weakening earnings outlook, clearly tells us the market is pricing in a more optimistic outlook for the economy and corporate profits. But perhaps much of that move may be justified based on rising odds of a soft landing. Recent strength in the jobs market, while worrisome for the Fed, along with healthy consumer balance sheets and manageable debt loads, position the U.S. economy to potentially muddle through.

Valuations are fair by our assessment, not rich, and enable some upside potential as the market gains additional visibility into the potential resumption of earnings growth later this year and into 2024. LPL Research’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its overweight recommendation on equities and 2023 year-end fair value target of 4,400 to 4,500, based on 18.5 times 2024 earnings per share of $240.

Jeffrey Buchbinder, CFA, Chief Equity Strategist, LPL Financial

Quincy Krosby, PhD, Chief Global Strategist, LPL Financial

Jeffrey Roach, PhD, Chief Economist, LPL Financial

Trying to Stick the Landing: Can the Stock Market Do It?