Will History Rhyme? A Fed Pause Has Been Good for Fixed Income

Economists like to remind us there is no such thing as a free lunch. In investment parlance, that just means all investments carry risk—even cash. And the big risk with cash is reinvestment risk. That is, while short-term rates are currently elevated, the risk is these rates won’t last and upon maturity, investors will have to reinvest proceeds at lower rates. And if this current cycle follows history, we could see lower core bond yields over the next year, which would mean cash-only investors may miss out on these higher yields. LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) recommends investors maintain a neutral duration relative to benchmarks with the expectation that Treasury yields are likely headed lower (or at least not much higher) over the next few quarters.

Balancing Short-Term Opportunities with Longer-Term Objectives

After the most aggressive rate hiking campaign in decades from the Federal Reserve (Fed), short-term interest rates are at levels last seen early in the 2000s. Moreover, due to the elevated fed funds rate and the subsequent carryover into the U.S. Treasury market, the Treasury yield curve is the most inverted since the early 1980s (that is shorter-term Treasury securities out yielding longer-maturity securities). This has (finally) allowed investors to generate a return on cash.

However, the Fed’s goal has been to take the fed funds rate into restrictive territory to make the cost of capital prohibitively expensive to slow aggregate demand, which should allow inflationary pressures to abate. Then what? Well, after winning its fight with inflation, markets expect the Fed to start cutting rates as early as this year. After keeping rates at these elevated levels, the Fed will then likely take the fed funds rate back to a more neutral level, which economists believe is 2.5%, or even lower. Just as the aggressive rate hiking cycle took Treasury yields higher, interest rate cuts will take Treasury (and other bond market) yields lower, and that is when the reinvestment risks will show up. And since inflationary pressures are easing, as cracks appear in the regional banking sector, it is likely the Fed is done with its rate hiking campaign, which could be welcome news for core bonds.

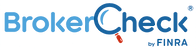

In fact, if the Fed is indeed done raising interest rates, we could start to see lower yields on intermediate-term securities before the Fed actually cuts rates. Of the most recent Fed rate hiking campaigns (Figure 1), 10-year Treasury yields were lower, on average, by 1% a year after the Fed stopped raising rates. And while our base case remains a trading range for the 10-year yield between 3.25% and 3.75% throughout 2023 (similar to the 2006 Fed rate hiking campaign, when the Fed kept rates at elevated levels for over a year), we acknowledge there is a strong bias for yields to end the year lower than our expectations, which could mean strong positive returns for core bonds.

Now, we also acknowledge there is a risk that inflationary pressures remain high and that the Fed has to continue its rate hiking campaign into a weakening economy. As we mentioned in our Outlook 2023: Finding Balance, in that stagflationary scenario where the Fed takes the fed funds rate to 6%, we could see the 10-year around 4.75%. However, given where starting yields are, if interest rates increase by another 1% from current levels, fixed income markets broadly could all still generate slightly positive returns over the next 12 months.

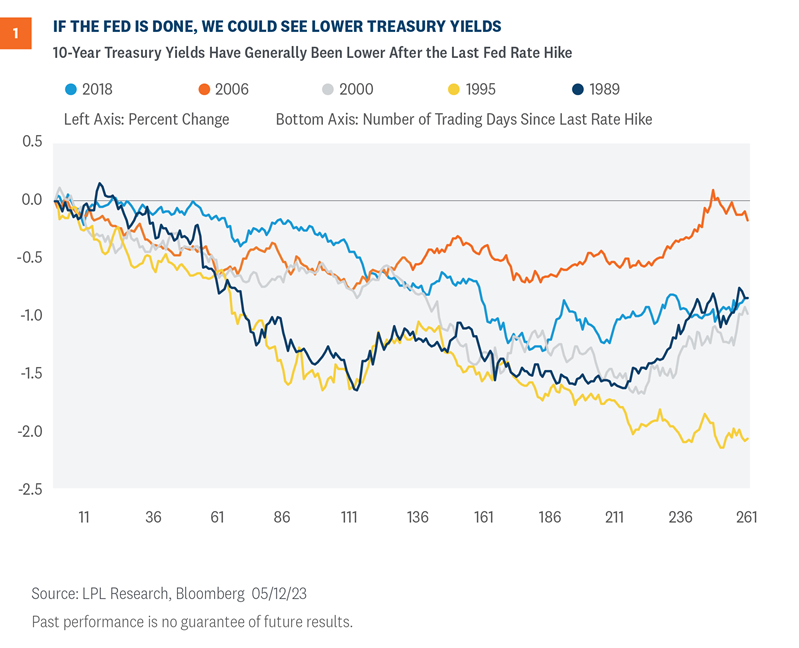

Technical Trends Suggest the Highs Are In

The technical setup for Treasuries suggest high watermarks for yields have likely been reached (Figure 2). Since core consumer inflation in the U.S. peaked last fall, 10-year yields have registered a string of lower highs that together form a developing downtrend. The recent bearish crossover of the 10-year yield’s 50-day moving average below the 200-day moving average adds to the evidence of a potential downtrend in the making. (For reference, moving averages represent the average yield across a select number of trading days and are used to identify trend direction.) The key word here is “potential,” as yields have not registered consecutive lower lows, a major piece of missing evidence to confirm a new downtrend is officially underway.

Despite several retests, support for the 10-year at 3.25% continues to hold. While this level is attributed to the recent April lows, it also traces back to the 2018 highs, a major breakout point for yields as they officially completed a multi-year bottom formation. Given the significance of the 3.25% support level and what we view as limited upside risk for yields based on both technical and macro factors, we suspect 10-year yields will remain range bound in the 3.25% to 3.75% range until a confirmed trend develops.

If History Rhymes…

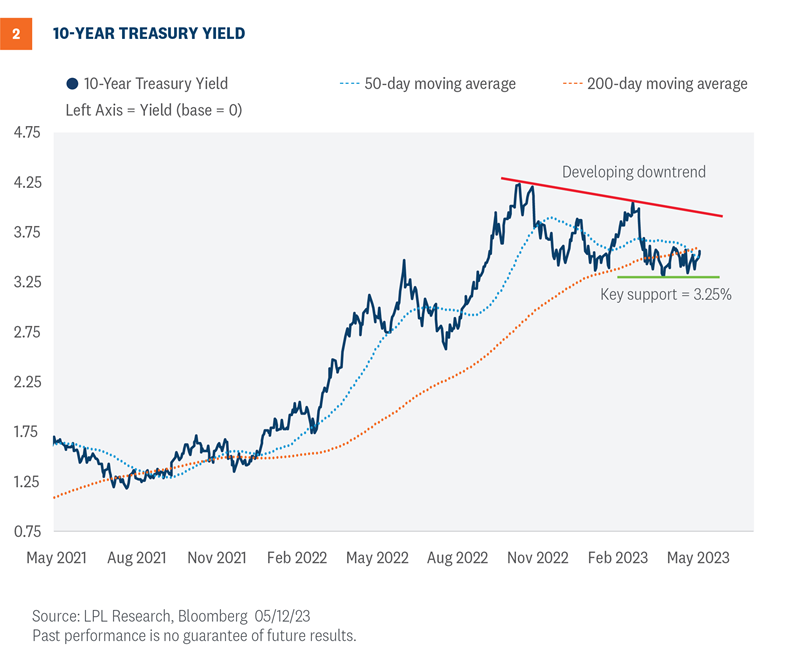

If history at least rhymes during this cycle and we do see lower yields over the next year, intermediate core bonds could very well outperform cash and other shorter maturity fixed income strategies. Historically, core bonds, as proxied by the Bloomberg Aggregate Bond Index, have performed well during Fed rate hike pauses (Figure 3). Since 1984, core bonds were able to generate average 6-month and 1-year returns of 8% and 13%, respectively, after the Fed stopped raising rates. Moreover, all periods generated positive returns over the 6-month, 1-year, and 3-year horizons.

Conclusion

Within our discretionary asset allocation models, we’ve maintained a neutral duration relative to our benchmark (the Bloomberg Aggregate Index) with the expectation that Treasury yields are likely headed lower (or at least not much higher) over the next few quarters. And if yields fall from current levels, investors will have likely missed an opportunity to invest in yields we’ve not seen in over a decade.

While we certainly think cash is a legitimate asset class again, it’s all about balancing today’s opportunity with what may or may not be available tomorrow. So, unless investors have short-term income needs, they may be better served by reducing some of their excess cash holdings and by extending the maturity profile of their fixed income portfolio to lock in these higher yields for longer. Bond funds and ETFs that track the Bloomberg Aggregate Index, along with separately managed accounts and laddered portfolios, all represent attractive options that will allow investors to take advantage of these higher rates before they’re gone.

Lawrence Gillum, CFA, Chief Fixed Income Strategist, LPL Financial

Adam Turnquist, CMT, Chief Technical Strategist, LPL Financial