Who Is Right, Federal Reserve or Financial Markets?

Financial markets and the Federal Reserve are reading from two different playbooks. Who is right? The markets are pricing in several rate cuts by the end of this year, while the Federal Reserve communicated more rate hikes with an expectation of holding rates up throughout the balance of 2023. We think that markets have it right, but several factors need to play out for this outcome to prevail. If growth stalls and inflation materially slows, the Fed could cut yet keep real rates positive. Read more below for our reasoning and for what it means for your investments.

Rising Layoffs Could Ease Wages

The Federal Reserve (Fed) has reiterated its plan to raise rates at least one more time and keep rates elevated for the rest of 2023. At this stage of the economic cycle, the Fed is rightfully focused on its inflation mandate but as the economy slows and inflation cools, we think the Fed can shift to a more balanced focus on both price stability and full employment.

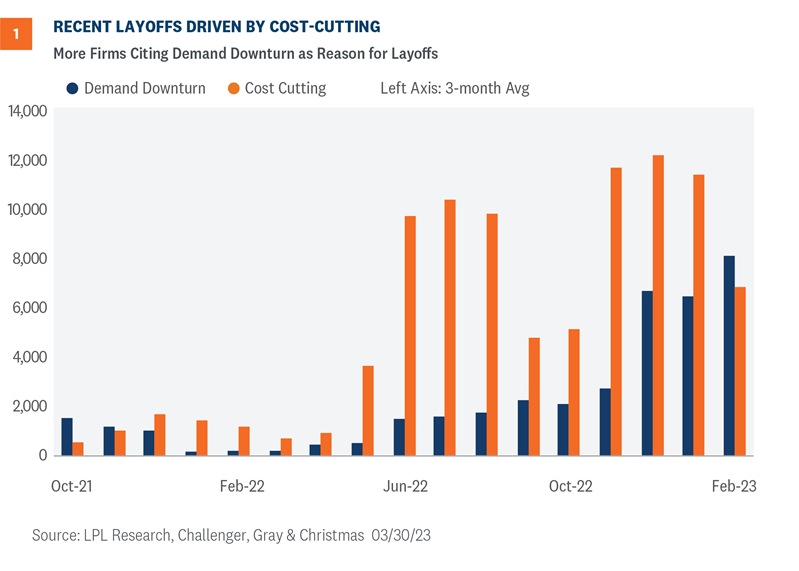

The labor market will be key to the outlook on rates this year. With yet another tech company announcing layoffs, the labor market should loosen as the economy slows and businesses tighten spending. Firms are laying off more of their workers as the economy is expected to slow down in Q2, releasing some of the wage pressure in the current job market. Before this year, most layoffs were driven by firms cutting costs, but now, firms are explicitly stating weaker demand as the reason for layoffs (Figure 1).

As the economy slows and firms experience a downturn in demand, additional companies will likely cut payroll in the coming months. A natural consequence of a smaller workforce will likely be reduced demand for office space, putting additional pressure on commercial real estate.

Despite rising layoff announcements, markets are taking these news items in stride, most likely because the slowdown in the economy and tighter financial conditions imply the Fed is close to the end of rate hikes. Recession risk is still elevated, which explains why markets and the Fed are at odds about the future path of interest rates. Markets are probably right that the Fed will cut rates by the end of the year.

Services Inflation Still a Problem

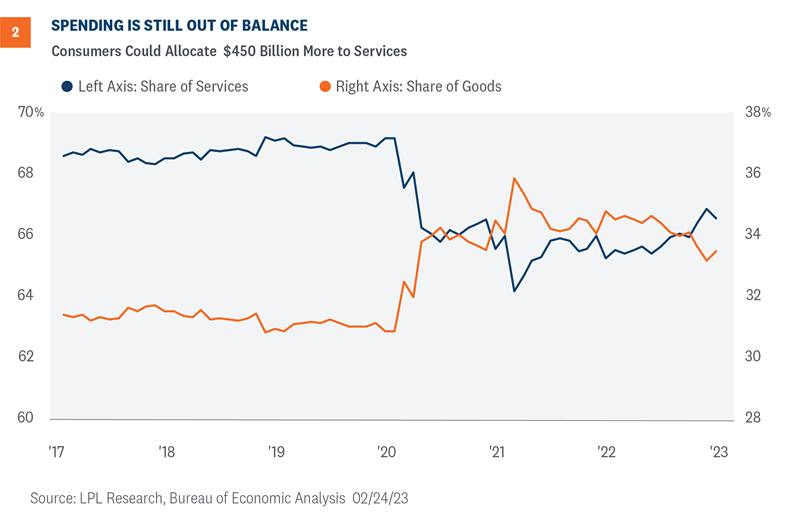

One reason the Fed is consumed with breaking inflation is that the improving trend in headline inflation is from declining goods prices. In contrast, services prices are stubbornly elevated, meaning consumer demand must fall if services inflation is to cool. But as the demand for services is strong as consumers release pent up demand, prices in many service sectors will likely remain elevated in the near term. Investors are watching the slow recalibration of goods and services spending. During those early years of the pandemic, consumers reallocated toward spending more on goods and less on services. The return to “normal” has been slow, as the share of services spending is still roughly 2.5 percentage points below pre-pandemic share as of the latest report (Figure 2).

Investors should take note of the composition of spending to understand the underlying inflationary trends. This differential means consumers could reallocate roughly $450 billion from goods to services as the composition of spending normalizes throughout the year. Investors and policy makers must accept that inflation metrics will be skewed until consumers recalibrate their composition of spending. Transportation services prices outright declined for the first time in three months due to a decline in airline prices. If consumers have more pent up demand for travel and experiences, prices within travel-related sectors could stay elevated through the summer. When it comes to housing, data show that prices for new leases are falling, so it’s just a matter of time before the official metrics capture this downward trend.

Treasury Markets

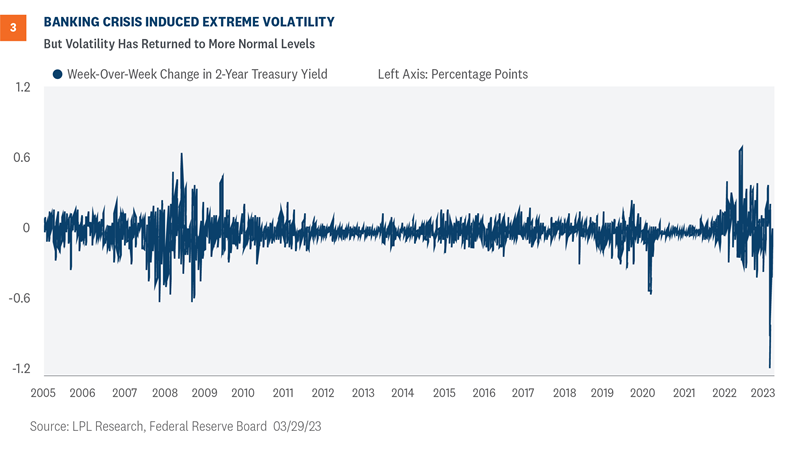

Changing Fed rate hike expectations can be seen clearly in the elevated levels of volatility in the normally staid U.S. Treasury market. The 2-year Treasury yield, which is most sensitive to policy expectations, saw daily moves of plus or minus 0.20% during the banking crisis. Moreover, it averaged about half a percentage point (50 basis points) between the highs and lows each day that week. A move of a couple of basis points is usually considered a lot for the security.

The erratic movements were likely being exacerbated by poor liquidity in the Treasury market. A Bloomberg index shows trading liquidity for Treasuries has gotten five times worse since 2021, and outside of a short spike in the early days of the pandemic, is worse than at any time since the financial crisis. Nonetheless, the volatility in presumably the safest bond market in the world has been unprecedented. We would advise investors to take advantage of any back up in yields and add high-quality fixed income exposure. Those investors who are fully allocated to fixed income should view recent volatility as more noise than signal.

What does this mean for you?

We think the economy will eventually hit its stride, notwithstanding unforeseen global shocks. Hitting that stride may not come until the Fed’s rate hiking campaign is closer to its end, but we expect stock investors to benefit once it does. Higher interest rates are challenging stock valuations and perhaps pushing the gains further out in 2023, but we still see solid potential for double-digit—if not mid-teens—returns for stocks this year. The S&P 500 returned more than 7% in the first quarter, so it’s well on its way to a double-digit year.

The LPL Research Strategic and Tactical Asset Allocation Committee (STAAC) recommends a slight overweight allocation to equities, narrowly favors value over growth, has moved to benchmark-level exposure for small and large caps, has the industrials sector as its top pick, and has warmed up to the technology sector, where the overall view is currently neutral but the technical analysis picture has improved significantly this year. The Committee has reduced its allocations to the energy and healthcare sectors in response to weakening technical analysis trends.

Within fixed income, the Committee recommends an up-in-quality approach with a benchmark weight to duration. We think core bond sectors (U.S. Treasuries, Agency MBS, and short-maturity investment grade corporates) are currently more attractive than plus sectors (high-yield bonds and non-US sectors) with the exception of preferred securities, which look attractive after having recently sold off due to the banking stresses.

Jeffrey Buchbinder, CFA, Chief Equity Strategist

Lawrence Gillum, CFA, Fixed Income Strategist

Jeffrey Roach, PhD, Chief Economist